What You Need To Know About The ABLE Act and Tax Free Savings Accounts

One of the biggest hurdles parents of children with special needs face is preparing for the future. With income restrictions on many benefit programs, it can be difficult for parents to plan for their child’s future needs. Recently, however, Congress has introduced legislation called the Achieving a Better Life Experience (ABLE) Act, which would enable parents of special needs children to have a tax-free savings account similar to a college savings account to provide funds for the future care of their children.

What is the ABLE Act?

The ABLE Act was introduced in 2012 and enjoyed wide bipartisan support in both the House and Senate. Because it was never called for a vote, it was reintroduced in 2013 as H.R. 647 (introduced by Rep. Ander Crenshaw, R-FL) and S. 313 (introduced by Sen. Robert Casey, D-PA). As of February 15, 2013, the bill was referred to the House Subcommittee on Health and the Senate Subcommittee on Finance. The authority to create the accounts would be created under a new sub-section of the IRS code governing Qualified Tuition programs (529(f) of the Internal Revenue Code).

How The Able Act Works

Under the ABLE Act, families would be able to set aside funds into a tax-free savings account. The funds could be withdrawn to cover costs associated with health care, employment, housing, transportation, and education. The funds would supplement but not replace benefits provided by Medicaid, Social Security, and private insurance and would not jeopardize a child’s eligibility for federal benefit programs.

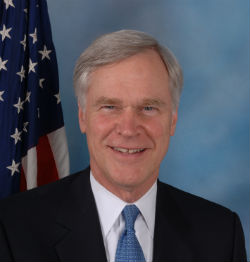

[caption id="attachment_11421" align="alignright" width="250"] U.S. Rep. Ander Crenshaw of Florida is sponsoring the Achieving a Better Life Experience Act, also known as the ABLE Act, that will help people caring for individuals with special needs.[/caption]

U.S. Rep. Ander Crenshaw of Florida is sponsoring the Achieving a Better Life Experience Act, also known as the ABLE Act, that will help people caring for individuals with special needs.[/caption]

The accounts would allow families to provide for extra costs associated with every day activities and community inclusion. The accounts would be available in any state, and have the same tax structure of traditional college savings accounts.

The income earned in the account is not taxed and withdrawals for qualified disability expenses are also tax-free. Contributions to the account, like traditional college savings plans, are considered tax-free gifts for purposes of the IRS. Thus, while there is no maximum or minimum that can be put in the account, the contribution would only be tax-exempt up to $14,000 each year. However, each parent is allowed to make a contribution for a total of $28,000 each year, tax-free. Should the ABLE Act pass, parents are encouraged to contact a tax or financial planning expert for more information.

Lauren Potter of Glee about the ABLE Act

What Expenses Are Allowed Under the ABLE Act?

The ABLE Act allows tax-free withdrawals of funds from the account for qualified disability expenses. These include:

Health Care, Prevention and Wellness:

- Premiums for health insurance

- Mental health, medical, vision, and dental expenses

- Habilitation and rehabilitation services

- Durable medical equipment (DME)

- Therapy

- Respite care

- Long-term services and supports

- Nutritional care

- Communication services and devices

- Adaptive equipment

- Assistive technology

- Personal assistance

Employment Support:

- Expenses relating to obtaining and maintaining employment

- Job-related training

- Assistive technology

- Personal assistance supports

Housing:

- Rent (primary residence)

- Home purchase (primary residence)

- Mortgage payments

- Home improvements and modifications

- Home maintenance and repairs

- Property taxes

- Utilities

Transportation:

- Mass transit costs

- Purchase and/or modification of a vehicle

- Moving expenses

Education:

- Tuition (preschool through post-secondary education)

- Books

- Supplies

- Tutors

- Special Education Services

Other Expenses:

- Financial management

- Account administration services

- Legal fees

- Expenses for oversight or account monitoring

- Funeral and burial expenses

- Assistive Technology and Personal support expenses are allowed as they pertain to any of the above categories.

It is possible that this list will change if and when the bill is approved and regulations are developed.

Who Qualifies for an ABLE Account?

Any person receiving SSI or SSDI or any person who has a “medically determined physical or mental impairment, which results in marked and severe functional limitations, and which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months,” or one who is blind.

Persons may need to provide a copy of their diagnosis signed by a physician, or an affidavit (signed statement) from a parent or guardian regarding the child’s diagnosis and functional limitations.

How will the ABLE Account Impact My Child’s Federal Program Benefits?

Those with an ABLE Account will still be eligible to receive Medicaid benefits and SSI. However, when the amount in an ABLE Account reaches $100,000, any monthly SSI benefits would be placed in suspension. If the account drops below $100,000, the monthly SSI benefits would resume (meaning the person would not have to re-apply for SSI).

Also, in the event the beneficiary dies or is no longer considered to have a disability and there is money remaining in the account, that money would be given to any State Medicaid plans that provided medical assistance. The amount of Medicaid payback would be calculated based on amounts paid by Medicaid only after the ABLE Account was created.

What Happens Next?

The bill is currently being reviewed by legislative committees. Thus, the language and details of the legislation may change. If the bill gets approved and signed into law, the IRS would then develop regulations to implement and administer the rules governing the accounts. This process takes time and there is no guarantee that the bill will be passed or that it will look the same as it does as of the time of this publication. However, parents are encouraged to contact their Representatives and Senators to urge them to support the bill. To stay up-to-date on the latest happenings with both the Senate and House versions of the bill, please click the links below:

Link to the House Bill: http://thomas.loc.gov/cgi-bin/query/z?c113:H.R.647:

Link to the Senate Bill: http://thomas.loc.gov/cgi-bin/query/z?c113:S.313: